Discover Wyoming Federal Credit Union: Your Trusted Financial Partner

Discover Wyoming Federal Credit Union: Your Trusted Financial Partner

Blog Article

Optimize Your Cost Savings With a Federal Credit Score Union

Discovering the globe of Federal Lending institution for maximizing your cost savings can be a critical financial relocation worth considering. The benefits, ranging from higher passion prices to tailored financial savings alternatives, offer an engaging chance to reinforce your monetary health and wellness. By understanding the alternatives and advantages available, you can make educated decisions that line up with your savings goals. Let's dive right into the nuances of optimizing your savings potential through the distinct offerings of a Federal Credit Rating Union and how it can pave the method for a much more safe financial future.

Benefits of Federal Cooperative Credit Union

Federal Credit scores Unions are guaranteed by the National Credit Union Management (NCUA), giving a comparable level of defense for down payments as the Federal Deposit Insurance Policy Corporation (FDIC) does for financial institutions. Overall, the benefits of Federal Credit rating Unions make them a compelling option for individuals looking to optimize their savings while receiving individualized service and assistance.

Membership Eligibility Criteria

Subscription qualification requirements for Federal Lending institution are developed to manage the qualifications people should satisfy to enter. These standards make certain that the lending institution's subscription stays exclusive to people that satisfy details needs. While qualification standards can differ slightly between various Federal Lending institution, there are some usual factors that applicants may experience. One regular standards is based on the individual's area, where some credit history unions offer particular geographical areas such as a certain area, company, or association. This aids produce a feeling of neighborhood within the lending institution's membership base. Additionally, some Federal Cooperative credit union might require people to come from a particular occupation or sector to be qualified for subscription. Family partnerships, such as being a relative of a present member, can also usually work as a basis for membership qualification. Recognizing and satisfying these criteria is essential for individuals looking to sign up with a Federal Cooperative credit union and make the most of the financial advantages they provide.

Cost Savings Account Options Available

After identifying your qualification for subscription at a Federal Cooperative Credit Union, it is essential to check out the numerous savings account choices readily available to optimize your financial benefits. Federal Credit score Unions usually use a series of savings accounts tailored to fulfill the diverse needs of their participants. One usual choice is a Routine Savings Account, which acts as a foundational represent participants to deposit their funds and gain affordable returns. When required., these accounts usually have low minimum balance demands and give Full Article very easy access to funds.

An additional preferred choice is a High-Yield Financial Savings Account, which supplies a higher rate of interest contrasted to normal savings accounts. This sort of account is excellent for participants wanting to earn a lot more on their financial savings while still maintaining versatility in accessing their funds. Furthermore, some Federal Cooperative credit union supply specific interest-bearing accounts for particular savings goals such as education and learning, emergency situations, or retirement.

Tips for Conserving More With a Credit Union

Looking to improve your cost savings potential with a Federal Cooperative Credit Union? Right here are some pointers to assist you conserve much more effectively with a credit report union:

- Make Use Of Greater Passion Rates: Federal Cooperative credit union generally provide higher rates of interest on interest-bearing accounts contrasted to conventional banks. By transferring your funds in a cooperative credit union interest-bearing account, you can earn more passion gradually, aiding your savings grow quicker.

- Explore Different Cost Savings Products: Cooperative credit union use a range of cost savings items such as deposit slips (CDs), cash market accounts, and individual retired life accounts (Individual retirement accounts) Each item has its very own benefits and attributes, so it's important to explore all alternatives to discover the very best fit for your financial savings objectives.

- Establish Automatic Transfers: Arrange automated transfers from your checking account to your lending institution savings account. By doing this, you can continually add to your financial savings without having to think of it regularly.

Comparing Credit Union Vs. Standard Financial Institution

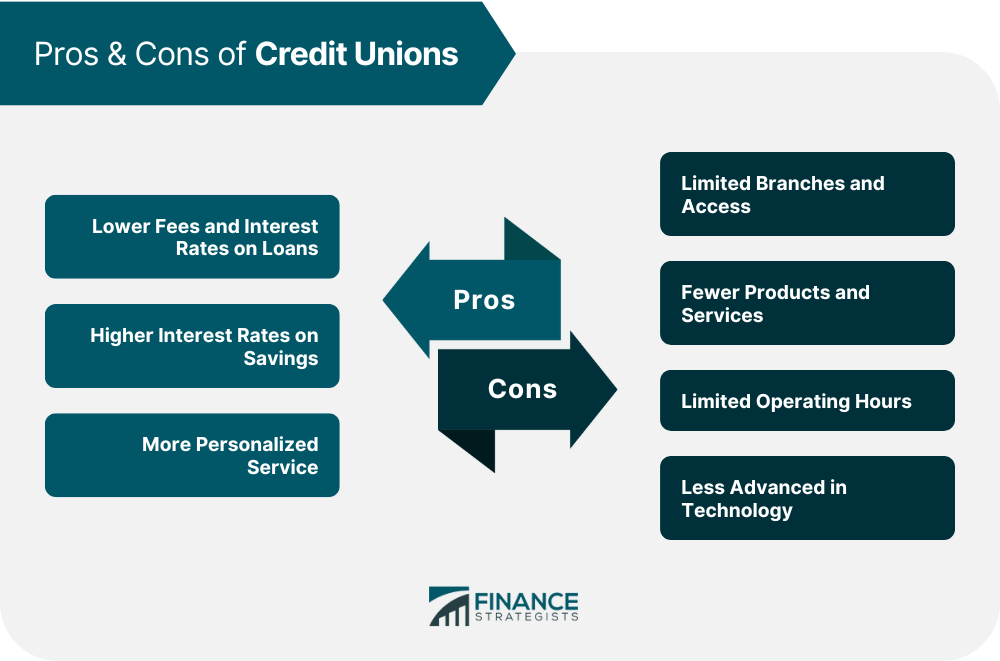

When examining financial establishments, it is important to consider the distinctions in between lending institution and conventional banks. Credit rating unions are not-for-profit organizations owned by their participants, while standard banks are for-profit entities possessed by investors. This essential difference frequently converts right into far better interest prices on cost savings accounts, reduced finance prices, and less costs at cooperative credit union contrasted to banks.

Cooperative credit union generally supply a much more personalized approach to financial, with a concentrate on area involvement and participant satisfaction. In comparison, traditional financial institutions might have a much more comprehensive series of places and services, but they can sometimes be perceived as less customer-centric as go right here a result of their profit-oriented nature.

An additional secret difference remains in the decision-making process. Lending institution are regulated by a volunteer board of directors chosen by participants, making sure that decisions are made with the most effective interests of the members in mind (Credit Unions Cheyenne WY). Typical financial institutions, on the various other hand, operate under the direction of paid execs and shareholders, which can in some cases result in decisions that prioritize revenues over customer advantages

Eventually, the option in between a lending institution and a standard bank depends on individual preferences, financial goals, and financial needs.

Conclusion

Finally, maximizing cost savings with a Federal Credit report Union uses countless advantages such as see here now higher rate of interest rates, reduced funding rates, decreased costs, and extraordinary consumer solution. By benefiting from various savings account choices and checking out numerous savings products, individuals can customize their savings technique to satisfy their monetary objectives effectively. Choosing a Federal Credit Union over a standard financial institution can result in better savings and monetary success in the future.

Federal Credit rating Unions are guaranteed by the National Credit Score Union Management (NCUA), providing a similar degree of protection for down payments as the Federal Down Payment Insurance Policy Firm (FDIC) does for banks. Cheyenne Credit Unions.After identifying your qualification for membership at a Federal Credit Rating Union, it is crucial to check out the different financial savings account alternatives readily available to maximize your financial benefits. Additionally, some Federal Credit score Unions give specific savings accounts for certain financial savings objectives such as education, emergency situations, or retired life

By transferring your funds in a credit report union savings account, you can gain even more passion over time, aiding your savings expand faster.

Explore Different Cost Savings Products: Credit scores unions provide a variety of financial savings products such as certificates of deposit (CDs), cash market accounts, and specific retired life accounts (Individual retirement accounts)

Report this page